Auto Insurance Coverage For Your Family Vehicles for Dummies

In terms of defending the individuals and automobiles that make any difference most, car insurance plan coverage for Your loved ones motor vehicles is a thing you could’t pay for to miss. Think it over: your autos aren’t just metal and wheels—they’re extensions of one's Life style, carrying your Children to highschool, commuting to operate, or taking you on weekend adventures. Wouldn’t you really feel extra at relieve knowing that whatever transpires on the road, you’re included? It’s not pretty much pursuing the legislation; it’s about comfort, monetary protection, and maintaining All your family members Risk-free when the unforeseen strikes.

Many families make the error of imagining just one generic coverage will match all their vehicles, but car insurance coverage coverage for your family vehicles is a lot more nuanced than that. Each vehicle inside your house could possibly have diverse wants depending on its price, utilization, and who drives it. By way of example, a teenage driver’s initially motor vehicle involves far more defense than the usual very well-managed minivan that only sees weekend use. Deciding on coverage customized to every motor vehicle makes certain that you aren’t underinsured when you want it most and that you simply’re not overpaying for protection that doesn’t match your predicament.

Have you ever at any time questioned how insurance policies firms work out premiums for multiple vehicles? It’s like looking to bake a cake with unique elements—Each and every car adds a layer of chance, but clever bundling can in fact help save you money. Vehicle insurance plan coverage for your family automobiles generally comes along with multi-auto reductions which make it far more very affordable than getting different insurance policies. It’s a little like obtaining in bulk at the grocery store: you will get much more for less, but only if you comprehend Anything you’re in fact paying for.

Auto Insurance Coverage For Your Family Vehicles for Dummies

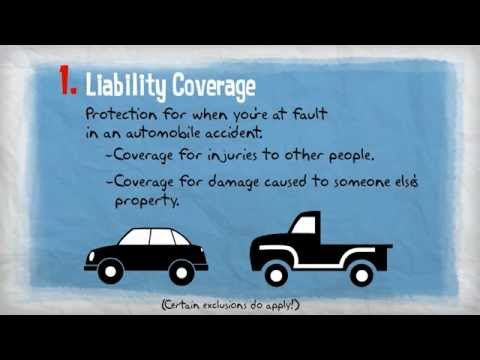

Naturally, the kind of protection issues just just as much as the volume of motor vehicles. Liability insurance plan might include the destruction you induce to Some others, but what about your have family car or truck when an accident occurs? Thorough and collision coverage guards your motor vehicles from several different incidents like accidents, theft, or purely natural disasters. Envision leaving your automobile in a parking zone and returning to seek out it harmed by a fallen tree branch. Without the need of comprehensive protection, that may be an out-of-pocket nightmare. Automobile coverage coverage for All your family members vehicles ensures you’re All set for these unanticipated moments.

Naturally, the kind of protection issues just just as much as the volume of motor vehicles. Liability insurance plan might include the destruction you induce to Some others, but what about your have family car or truck when an accident occurs? Thorough and collision coverage guards your motor vehicles from several different incidents like accidents, theft, or purely natural disasters. Envision leaving your automobile in a parking zone and returning to seek out it harmed by a fallen tree branch. Without the need of comprehensive protection, that may be an out-of-pocket nightmare. Automobile coverage coverage for All your family members vehicles ensures you’re All set for these unanticipated moments.Let’s look at the human component. Drivers make mistakes—it’s inescapable. Teenagers might be inexperienced, when adults occasionally get distracted by operate phone calls or texting. Automobile insurance coverage protection for your family motor vehicles can help cushion the money blow when blunders come about, rendering it less of the disaster plus more of the manageable inconvenience. Consider it as a security net that catches you before the fall becomes catastrophic, allowing you to focus on Restoration as an alternative to expenditures.

A different angle could be the satisfaction that comes with roadside support. A lot of family members neglect this perk, but it might be a lifesaver when your automobile breaks down on a deserted freeway or in the middle of Winter season. Automobile insurance coverage coverage for Your loved ones autos usually incorporates solutions like towing, battery bounce-begins, and also emergency gas shipping and delivery. Picture currently being stranded with Youngsters in the vehicle and acquiring an expert cope with the issue—that kind of support is priceless and often disregarded when men and women buy insurance.

Economic scheduling is one more reason people require good automobile insurance plan protection for your family vehicles. Accidents materialize, and maintenance expenditures can skyrocket promptly. A insignificant fender bender can Charge hundreds, although main collisions can easily achieve Many pounds. With the ideal coverage, these expenses don’t appear outside of Your loved ones’s cost savings. Alternatively, your insurance policy functions like a buffer, smoothing out the economic bumps to help you sustain balance and maintain daily life working efficiently even though the unpredicted happens.

Have you ever ever considered the lawful side of things? Driving with no satisfactory insurance coverage may have significant repercussions, which includes fines, license suspension, or even lawsuits. Automobile coverage coverage for All your family members motor vehicles is not just a smart decision—it’s a authorized requirement for most states. By ensuring Just about every within your autos is thoroughly insured, you’re not just safeguarding your family and also avoiding authorized complications that may snowball into very long-term complications.

It’s not just accidents that auto insurance coverage coverage for Your loved ones automobiles shields towards. Theft, vandalism, and organic disasters like hail or flooding can go away you devoid of transportation and facing costly repairs. Comprehensive coverage methods in to handle these situations, meaning you don’t need to deplete your emergency fund just to get back on the road. Such a protection acts similar to a protect, standing between Your loved ones along with the unanticipated financial pressure that lifestyle in some cases throws at you.

Coverage isn’t just one-dimensions-fits-all, and neither is your family’s driving scenario. Most likely 1 auto is used for commuting, whilst One more is actually a weekend getaway automobile. Car insurance protection for Your loved ones automobiles can be custom-made to match utilization designs, making certain you’re not paying for unwanted protection on a vehicle that sees minimum miles. This customized solution will save dollars even though even now offering robust protection, that is a acquire-earn for almost any household planning to stability security and price range.

Auto Insurance Coverage For Your Family Vehicles - Questions

Sometimes it’s the little things that make the largest difference. Are you aware that characteristics like anti-theft gadgets, driver protection courses, and perhaps superior credit score scores can affect your rates? Vehicle insurance coverage coverage for your family automobiles generally rewards households who choose proactive actions to lower hazard. It’s like obtaining a reduction for remaining accountable—a tangible profit for practices that also hold All your family members safer around the street.A further thing to consider is health care coverage. Accidents aren’t just about autos; persons can get hurt. Auto coverage protection for your family autos can involve health care payments protection or individual harm security, ensuring that the family members obtain prompt professional medical notice without the anxiety of sudden charges. It’s a form of treatment that extends beyond steel and rubber, demonstrating that coverage isn’t almost vehicles—it’s about defending All your family members’s well being and effectively-getting much too.

Let’s not ignore rental car protection. If one of Your loved ones motor vehicles is while in the shop after an accident, you’ll however have to have transportation. Automobile insurance policies protection for your family vehicles can consist of rental reimbursement, so that you’re not caught depending on public transport or borrowing from close friends. This helps make life easier and retains All your family members’s timetable on target, highlighting how in depth scheduling can stop slight setbacks from turning into important disruptions.

Looking for insurance policy can really feel too much to handle, but serious about Your loved ones’s requirements would make the process Significantly easier. Auto insurance policy coverage for Your loved ones motor vehicles isn’t merely a policy—it’s a discussion about priorities, lifestyle, and satisfaction. By breaking down coverage solutions, evaluating fees, and understanding the fantastic print, families will make knowledgeable selections that shield both their wallets as well as their family and friends. It’s like currently being the captain of a ship, steering All your family members securely via unpredictable waters.

Bargains are One more sweet spot in vehicle insurance policy coverage for your family vehicles. Multi-auto, excellent driver, bundling household and car, and loyalty reductions can considerably decreased rates. It’s value exploring just about every avenue due to the fact even a small reduction can add up once you’re insuring several automobiles. Visualize it as clipping coupons for cover—you’re continue to purchasing security, but smarter, not tougher.